Compounding Can Add Fuel to Your Portfolio

If you enter the terms “Albert Einstein” and “compounding” into an Internet search engine, you’ll discover a wide variety of quotes attributed to the great inventor. Some results say Einstein called compounding the “greatest mathematical discovery of all time,” while others say he called it the “most powerful force in the universe.” Despite the many variations, Einstein’s point is valid: compounding can add fuel to your portfolio’s growth. The key is to allow enough time to let it go to work.

Time and money can work together

The premise behind compounding is fairly simple. If an investment’s earnings are reinvested back into a portfolio, those earnings may themselves earn returns. Then those returns earn returns, and so on. For instance, say you invest $1,000 and earn a return of 6%–or $60–in one year. If you reinvest, combining that $60 with your $1,000 principal, and earn the same 6% the following year, your earnings in year two would increase to $63.60. Over time, compounding can snowball and really add up.

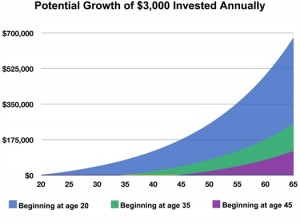

Say at age 45 you begin investing $3,000 annually in an account that earns 6% per year, with earnings reinvested. At age 65, your $60,000 principal investment would be worth almost twice as much–about $117,000. That’s not bad, right?

Now consider what happens if you begin investing at age 35, using the same assumptions. By 65, your $90,000 principal would nearly triple to just over $250,000.

Finally, consider the results if you start at age 20: your $135,000 investment would be worth a jaw-dropping five times as much–$676,524. That’s the power of compounding at work.

But how long do I have to wait?

If you’d like to estimate how long it might take for your investment to double, you can use a principle known in investment circles as the “Rule of 72.” To use the rule, simply divide 72 by the expected rate of return. For example, if you expect to earn an average of 8% over time, the Rule of 72 gauges that your investment would double in approximately nine years. (This rule applies to lump-sum investments, not periodic investment plans such as those given as examples in this article.)

With compounding, the more patience you have, the better off you may be over the long term. The examples in this article assume a steady 6% rate of return each year; however, in reality, no investment return can be guaranteed. Your actual earnings will rise and fall with the changing economic and market conditions. That’s why it’s so important to stay focused on the long term. Over time, the ups and downs may average out, and your earnings can potentially go to work for you.

Perhaps that’s why Einstein called compounding “man’s greatest invention.” Or was it the “eighth wonder of the world”? Regardless … you get the idea. When it comes to investing, time can be the power behind your potential success.

Note: The examples in this article are hypothetical and for illustrative purposes only. They assume a steady 6% annual rate of return, which does not represent the return on any actual investment and cannot be guaranteed. Moreover, the examples do not take into account fees and taxes, which would have lowered the final results. Speak with a financial professional about how these examples might relate to your own investing circumstances.