Monthly Investment Commentary | February 2013

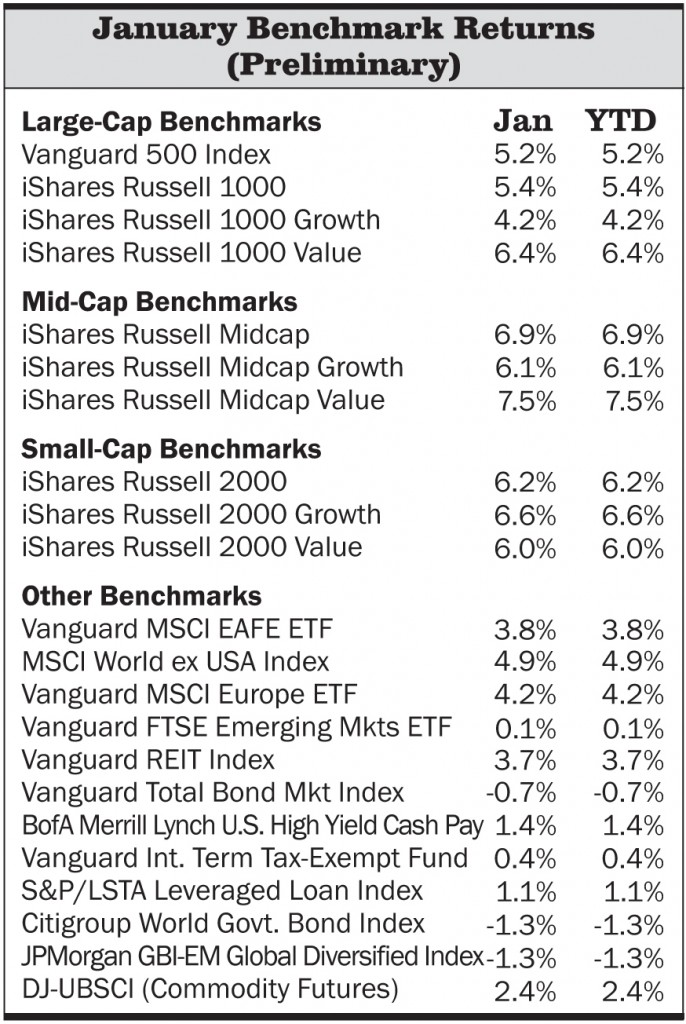

Stock markets logged their best January since the onset of the financial crisis. A resurgent demand for equity mutual funds reflected investor optimism over improving economic data and progress toward managing the fiscal cliff. Large-cap U.S. stocks rose 5% in January, while smaller-cap stocks gained 6%. Developed-market foreign stocks earned 4%, and emerging-markets equities were flat. As the yield on the 10-year Treasury climbed above 2%, domestic high-quality intermediate-term bonds declined 0.7%. Both foreign developed- and emerging-markets bonds fell 1.3%. Floating-rate loans, which we hold in our conservative accounts, rose 1.6% in January.

Research Team Q&A

We regularly use a question-and-answer format to address questions from readers about our investment views and current strategy. This format permits us to address a range of different topics and allows readers to focus on areas of interest. This Q&A piece was worked on jointly by members of our research team and tackles questions received during the past several weeks. We have grouped the questions into broad categories for convenience.

Portfolio Risk Management

You recently updated your asset class return estimates table, which has a five-year time horizon. Will you please speak about the biggest potential risks you see over the next year?

Our view of the biggest potential risks over the next year remains largely the same as it was last year. In the United States, this includes:

- the risk of a major market dislocation potentially caused by political dysfunction specifically stemming from debt/deficit policy disagreements,

- a market downturn sparked by unexpectedly poor earnings growth (and negative analyst earnings revisions), or

- an outright recession in the United States that could be triggered by any number of factors, given the currently weak economy.