Invest Like an Olympian

By: Natalie Colley

The Olympics may be over, but that doesn’t mean I’ve stopped thinking about them. In the final week of the games, Olympian Jenny Simpson made history by becoming the first American to medal in the 1500m track event. For those unfamiliar with track, 1500m is 100m short of a full mile. Jenny finished in 4:10.53, earning herself the bronze medal. As a once decently fast 1500m runner, myself, and an American, I feel a great sense of pride for what Jenny accomplished.

What I found especially inspiring and applicable to my distinctly non-Olympian life, however, was something Jenny said in an interview with Runner’s World after the race. “I want to be somebody that this country can really be proud to cheer for and I didn’t decide to want to be that person this week or this year. I wanted to be that person eight years ago and ten years ago…this has been a long ride of highs and lows.” As someone who is constantly thinking about personal finance, I couldn’t help but see the similarity between Jenny and successful investors.

Most successful investors didn’t magically wake up one morning with $1 million in their bank account. With the exception of a few outliers, the vast majority of millionaires got there by diligently saving, paycheck by paycheck, over a long period of time. They didn’t decide that they wanted to be financially secure this week or this year, they decided to be that person years ago and they diligently worked towards that goal.

For many Olympians, the road to success was filled with obstacles. Gymnast Simone Biles pursued her dreams of Olympic glory in the face of a tumultuous childhood. In Jenny Simpson’s interview with Runner’s World, Jenny described battling through injury earlier in the year, and then a cold that she came down with just days before the Olympics. But Olympians know to keep pushing through the tough times. When the chips are down, through injuries and other adverse circumstances, Olympians stick to the plan, leaning on their coach for support, and making minor adjustments as needed. Sound familiar?

To reiterate that point, the most elite athletes in the world use coaches to keep them on track – a crucial element to their success. In the world of personal finance, Financial Planners are the coaches that help their clients stick to the plan, especially during market “adversity”. It’s our job to cut through the noise, coaching our clients to focus on their goals and stay the course, adjusting the strategy, as needed, over time.

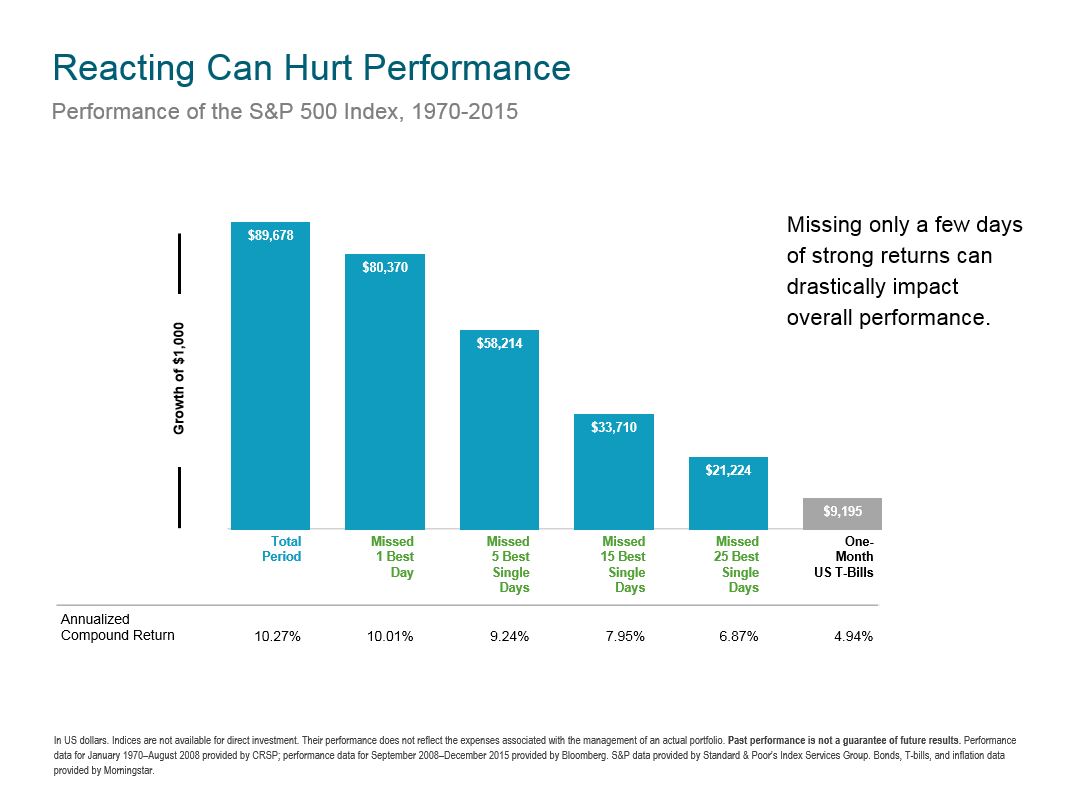

Without proper coaching, some investors stop investing during bad times, like in 2008 and in January of this year, when the market experienced significant declines. During a market downturn, those investors who move out of stocks miss out on the crucial market upswing that follows. Missing even a small number of good days in the market can have a substantial effect on long term returns. Investors who stayed fully invested in the S&P 500 from 1993 to 2013, a period that included huge downturns such as the tech bubble and the housing crisis, earned a 9.2% annualized return. Contrast that with investors who missed just 10 of the best days in that period and earned only 5.4% annualized (Source).

Like elite athletes, successful investors know that continuing to invest throughout the “bad times” is critical for their portfolio to come back even stronger. But they don’t decide to stick with it in the heat of the moment, when emotions are high and logical thinking is at an all-time low. Successful investing requires forethought, a plan, and dedication to stick with the plan, even (and especially) in bad times.

The title of Olympian may sound glamorous, but the day to day work to get to that level is often straightforward and mundane. To become the most decorated Olympian ever, phenom swimmer Michael Phelps trained in the pool six hours a day, six days a week, for years on end. Similarly, the path to becoming a millionaire is distinctly un-sexy. Save money consistently over a long period of time, continue to invest during market downturns, and lean on your coach for support.

Taking a page from Jenny Simpson’s Olympic handbook, the first step to successful investing may just be deciding what kind of investor you want to be ten or twenty years down the road.