Market downturns are like headaches – unwelcome and uncomfortable. And when you have one, you are always wondering when it will go away. You may be wondering when the current bear market will end. Before we answer that question, let’s first explore a particular cognitive bias and how it may be leading us to draw false conclusions about the current downturn.

Humans are bombarded with massive amounts of information every day. Our brains must develop and use shortcuts to deal with that information because we have limited resources to process it. These shortcuts are called cognitive biases. Overall, cognitive biases aren’t necessarily bad, but it is helpful to be aware of cognitive biases, particularly when they lead to an error in judgment or flawed decision-making.

One of the cognitive biases that most often affects investors is recency bias. Recency bias is the tendency to rely on the most recent information to predict what will happen in the future. For example, in a bear market, investors tend to be pessimistic and think that the recent downturn will continue. On the flip side as well, in a bull market, investors tend to think that the strong market activity will continue simply because that is what has been happening lately. Recency bias is to blame for many investors continuing to buy stocks at high prices and at the peak of market upswings, convinced that the hot market will only get hotter. Therefore, Warren Buffet reminds us to “be fearful when others are greedy, and greedy when others are fearful.”

If this year’s downturn feels painful, that’s understandable. By the end of the third quarter, the stock market (measured by the S&P 500) had fallen 2% or more in a single day eighteen times. This is the seventh largest number of drops of that magnitude for the year, with three months still to go. With this much pain, we would certainly expect that recency bias may be informing our expectations. How can we put this bias in perspective? First, we need to keep in mind that just because the markets are down now does not mean that is guaranteed to continue forever. If that is our expectation, recency bias may be to blame for that. Second, let’s look at some bear market history to see if we can answer our original question in a more unbiased manner. The last market downturn, in 2020, happened swiftly. The market fell 34% over 24 days and took just 104 days to recover. In terms of market movement, that is lightning fast. To provide contrast, BNY Mellon reviewed other recent bear markets and found the Dotcom Bubble required 1,167 days to recover (over three years) and the 2008 Global Financial Crisis required 1,022 days for the market to make a full recovery (just under three years).

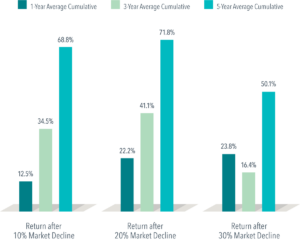

Just because that downturn happened most recently, doesn’t mean the current downturn will be similar. In fact, it is already turning out to be much different. Rather than focusing solely on recent downturns, let’s look at a broader time period. In the chart below, data averaging US Market Index Returns from July 1926 – December 2021 shows average cumulative returns after 10%, 20%, and 30% market declines. Since we know this downturn is already approaching a 30% market decline, let’s focus on those returns. On average, over a nearly 100-year period, market returns averaged over 50% cumulative return five years after the market decline.

“History Shows that Stock Gains Can Add up After Big Declines.” Dimensional Fund Advisors. June 9, 2022.

Is that a guarantee that we will emerge with 50% returns five years after the current market downturn? Of course not. We all know past performance does not guarantee future results. However, historical data is a better indicator than limited recent events and can help reassure us that market downturns happen, but don’t last forever. Just because it happened or is happening now, doesn’t mean it will continue. That, we know, is our recency bias, and putting it in perspective is important in helping us endure this current headache, stay invested, and make good long-term investment decisions.