In the world of investing, it’s easy to get caught up in the numbers and forget about the bigger picture. But in fact, the stock market really is just a numbers game. Understanding historical market returns and expected future returns can help investors make informed decisions about their portfolio.

2022 was a disappointing year for investment performance, with the traditional 60/40 portfolio having one of its worst years since the Great Depression. The primary driver of this was the Federal Reserve raising interest rates to combat inflation, which was having a significant impact on consumers at the gas pump and grocery store.

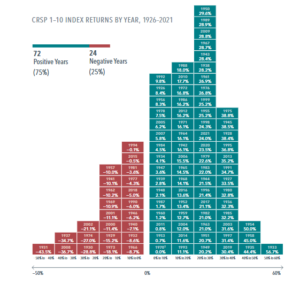

However, historical data shows that the majority of years (75%) have had positive returns in the market. It is important to keep this in mind and ensure that your portfolio is taking advantage of this growth over time. Even better news, stock and bond prices are lower, globally, making expected returns over the next 10 to 15 years much higher than they were a year ago.

For example, US large company stocks are expected to have almost an 8% return each year over the next 10 to 15 years. International stocks are expected to have an even higher return of almost 10% over the same time frame. These expected returns make it clear that investing in a robust, strong, and solid portfolio, and staying the course is key.

Overall, it’s important to remember that the stock market is a long-term game. It’s easy to get caught up in short-term losses or gains, but historical data, and expected returns based on that data, can help investors make informed decisions about their portfolio. By focusing on a robust and strong portfolio, investors can take advantage of the growth in the market over time.

Watch Stacy cover this topic on our YouTube channel here: