Over the weekend, news broke out about the coronavirus taking a larger hold outside China, as new cases were confirmed in Italy, South Korea, and Iran.

Companies worldwide are trying to predict the impact this virus will have on sales and their bottom lines. This uncertainty has led to the stock market to fall with the S&P 500 index down about 3% today.

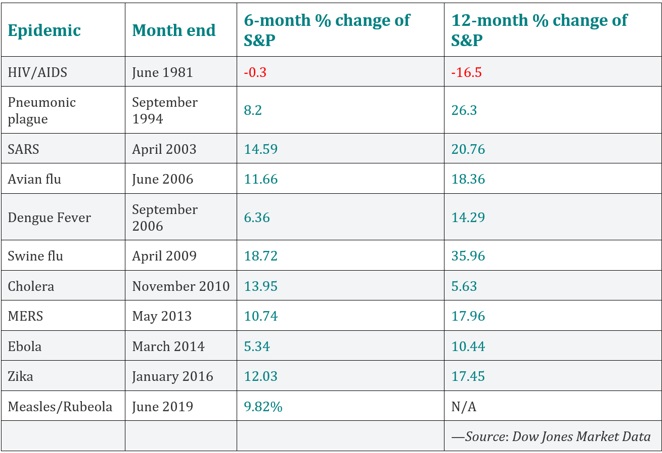

Despite the media hype, the markets’ reaction to previous epidemics has been short-lived. In January 2016, the Zika virus had a brief impact on stocks, but within six months, the S&P500 was up 12.03%, and in twelve months, it was up 17.45%. There are more examples in the history books, and they all show that while stocks may see a negative impact in the short term, in the long run, these events register as a blip.

If you are a fan of Warren Buffet, like we are, you may have found it heartening to hear him say on CNBC today, “The real question is: ‘Has the 10-year or 20-year outlook for American businesses changed in the last 24 or 48 hours?’”

“You’ll notice many of the businesses we partially own, American Express, Coca-Cola — those are businesses, and you don’t buy or sell your business based on today’s headlines. If it [the downturn] gives you a chance to buy something you like, and you can buy it even cheaper, then it’s your good luck,” he added.

Our message to our wealth management clients and friends is similar to Warren Buffet’s: while the news headlines might stir up emotions, don’t let that guide your long-term investment decisions. Long-term investors have nothing to fear, as the market will eventually rebound, as it always has.

If you are planning to imminently liquidate your portfolio for a large expense such as a renovation, home purchase, or another significant outlay, you should speak to a financial professional. It’s important to properly plan for this type of distribution while shielding you from market swings.

If you’d like more information, here is an article about the impact of coronavirus on the market from an economist that we highly respect.

If you’re interested in learning more about the services offered by Francis Financial, contact us for a free consultation by calling 212-374-9008 or emailing clientrelations@francisfinancial.com.