Monthly Investment Commentary | February Recap

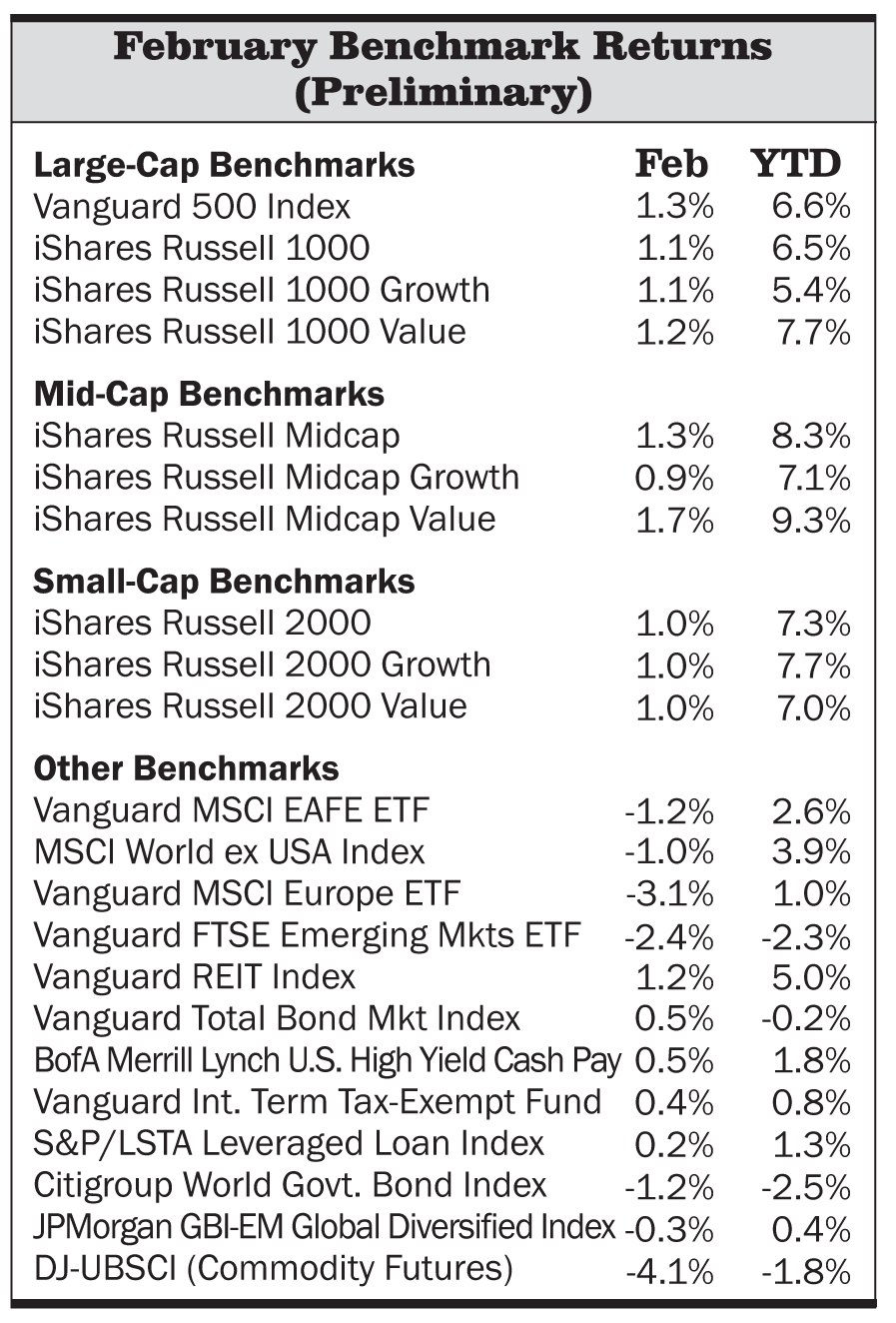

U.S. stocks and bonds were modestly positive in February. After posting strong returns in January, most stock indexes gained around 1% as investors weighed positive news, such as continued signs of a strengthening housing market, against concerns, such as the looming government sequester. On the fixed-income side, the core bond index returned 0.5% for the month, and floating-rate loans were up 0.2%.

Looking overseas, elections in Italy troubled European markets, which fell 3.1% in February, while the broad international market lost 1.2%. Emerging-markets stocks declined 2.4%. Foreign bonds also declined in February, dropping 1.2%, while emerging-markets bonds dipped 0.3%.

Strategy Update

As we write this, sequestration (automatic across-the-board federal budget cuts of $85 billion) has gone from a threat to a reality. We will comment briefly for those wondering whether or how this impacts our investment strategy. Generally speaking, the sequestration cuts are part of the broader fiscal issues around the deficit, which we’ve been writing about for some time. What we’ve said and continue to believe is that the overall environment is a challenging one that poses higher than normal risks—including that of policy errors that add to the economic damage. Sequestration is one component of that broader issue that is playing out in the near term, even while the longer-term debt and deleveraging issues remain. If a compromise is not reached within a few weeks, we expect to see the effects begin to show up in the economy, and over time they could be significant—possibly contributing to a recession (e.g., the Congressional Budget Office estimates the impact of sequestration will be roughly a 0.6 percentage point reduction in GDP growth this year). But while it is not possible to confidently predict how it will play out and what the impact will be, we are satisfied that broader fiscal issues are already factored into our longer-term assessment of the economic environment, including the risks and challenges that influence our current conservative bias.

As such, there are no material shifts in our thinking or investment strategy to report. We’ll give our usual thorough quarterly investment commentary next month, but generally speaking we continue to believe that while the “tail risk” of a really bad outcome (like a disorderly breakup of the eurozone) has lessened, and economic news has improved somewhat, the underlying headwinds from deleveraging will continue to weigh on economic growth in the years ahead. Stocks aren’t cheap, bonds are outright expensive, and the underlying problems faced by the global economy—Europe’s debt problem, our own fiscal mess, etc.—are still to be solved. In our Balanced portfolio, we remain underweighted somewhat to U.S. and developed international stocks, while fully weighted to emerging-markets stocks. On the bond side, we favor non-core strategies because Treasurys yield very little and expose us to risk from further rate increases. Our strategy continues to involve looking for acceptable and lower-risk near-term returns while waiting for better opportunities.