Third Quarter 2014 Investment Commentary

October 2014

Third Quarter 2014 Investment Commentary

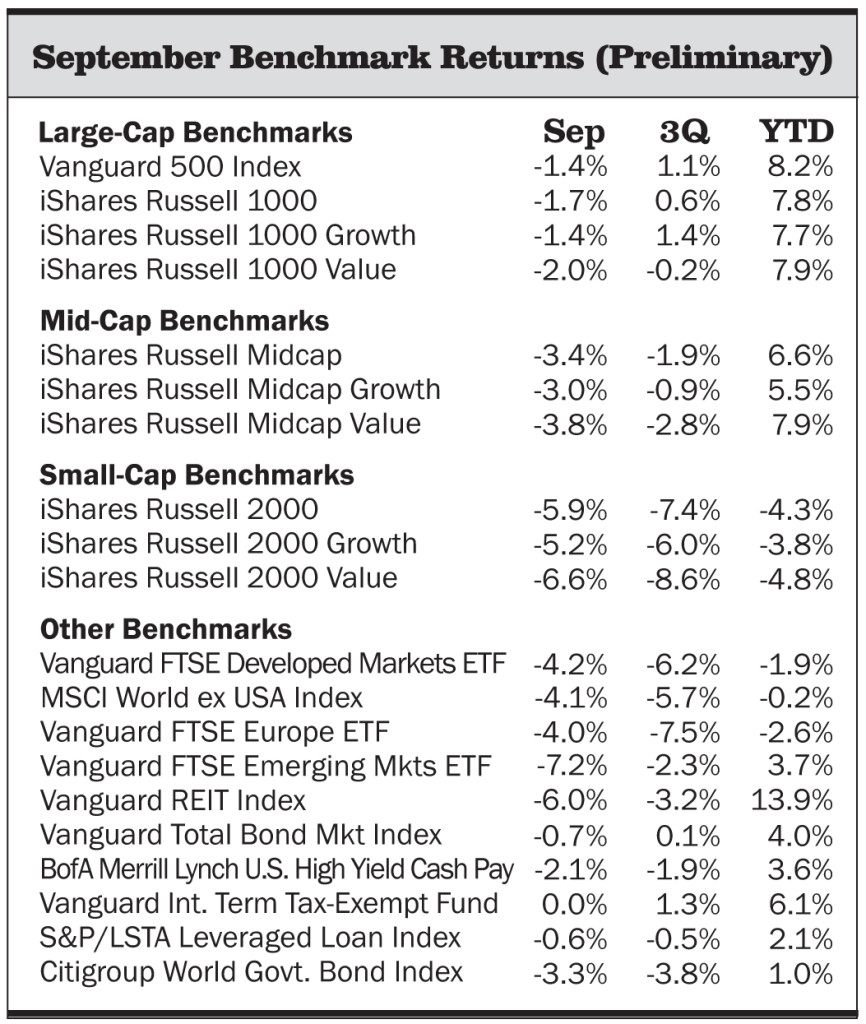

The quarter ended on a down note as global stock markets declined in September, leaving most broad market indexes we follow with losses for the quarter overall. In the United States, larger-company stocks managed a slight 1.1% gain for the quarter after falling 1.4% in September. (See our benchmark returns table for complete details.) Smaller-company stocks, which have had a challenging year so far, lost nearly 6% in September and were down 7.4% for the quarter. For the year to date, large caps have gained 8.2% versus a decline of 4.3% for the small-cap benchmark. Our portfolios are tactically underweight small caps—a beneficial stance given this year’s performance divergence between the two asset classes. Our view has been that while U.S. stocks, broadly speaking, are somewhat expensive relative to companies’ earning potential (i.e., valuations are high relative to fundamentals); small caps have been particularly overvalued and are, as an asset class, more vulnerable in market sell-offs.

The quarter ended on a down note as global stock markets declined in September, leaving most broad market indexes we follow with losses for the quarter overall. In the United States, larger-company stocks managed a slight 1.1% gain for the quarter after falling 1.4% in September. (See our benchmark returns table for complete details.) Smaller-company stocks, which have had a challenging year so far, lost nearly 6% in September and were down 7.4% for the quarter. For the year to date, large caps have gained 8.2% versus a decline of 4.3% for the small-cap benchmark. Our portfolios are tactically underweight small caps—a beneficial stance given this year’s performance divergence between the two asset classes. Our view has been that while U.S. stocks, broadly speaking, are somewhat expensive relative to companies’ earning potential (i.e., valuations are high relative to fundamentals); small caps have been particularly overvalued and are, as an asset class, more vulnerable in market sell-offs.

Developed international and emerging-markets stocks fell during the quarter, particularly in dollar terms as the U.S. dollar rose against other currencies. (A stronger dollar reduces returns on investments denominated in foreign currencies.) The Vanguard FTSE Developed Markets Index lost 6.2% for the quarter and is now down nearly 2% year to date. Emerging markets declined 2.3% in the third quarter, though they remain up 3.7% for the year.

The quarter’s financial market results were set against a now familiar set of macroeconomic and geopolitical considerations and concerns. These same issues have shaped markets over the course of the year as well. They include divergent economic outlooks around the globe, with the United States seemingly on a path of modest recovery, Europe facing stalled growth and potential deflation, and China continuing to seek a balance between maintaining sufficient economic growth on the one hand versus slowing credit growth and implementing economic reform on the other. Monetary policy is similarly varied. In the United States, the Federal Reserve’s wind-down of its quantitative easing bond-buying program (set to end in October) marks one milestone and focuses investors’ attention increasingly on the eventual hike in rates. During the quarter, Federal Reserve Board Chair Janet Yellen reiterated the Fed’s plan to keep rates at current levels for a considerable period of time after bond buying ends, leaving investors uncertain as to what that eventual policy shift will look like and when it will occur. Geopolitical issues (most recently with the escalation of U.S. military action in the Middle East) and stretched stock-market valuations in the United States are other key factors shaping performance. We review a few big picture issues a bit later in this commentary.

Core bonds declined very slightly in September as yields rose on the prospect of the Fed’s eventual exit from its easy money policies. For the quarter, the Vanguard Total Bond Market Index (our proxy for core bonds) was flat, though it remains up 4% for the year to date. High-yield bonds, which have been a bright spot for income-seeking investors, have had a choppy year and were down sharply in September as investors seemed to grow more cautious about taking credit risk for relatively little additional yield. This was a headwind for funds that own high-yield bonds or other types of credit-sensitive bonds, including corporate bonds and floating-rate loans.

From quarter to quarter, our longer-term (five-year) macroeconomic scenarios are unlikely to change, and this was the case in the third quarter. Similarly, in the absence of major market developments that might affect the attractiveness or risk of an investment opportunity, our outlook for individual asset classes has not changed materially from last quarter.

—Francis Financial & The Litman Gregory Research Team