Year-End Investment Commentary – January 2013

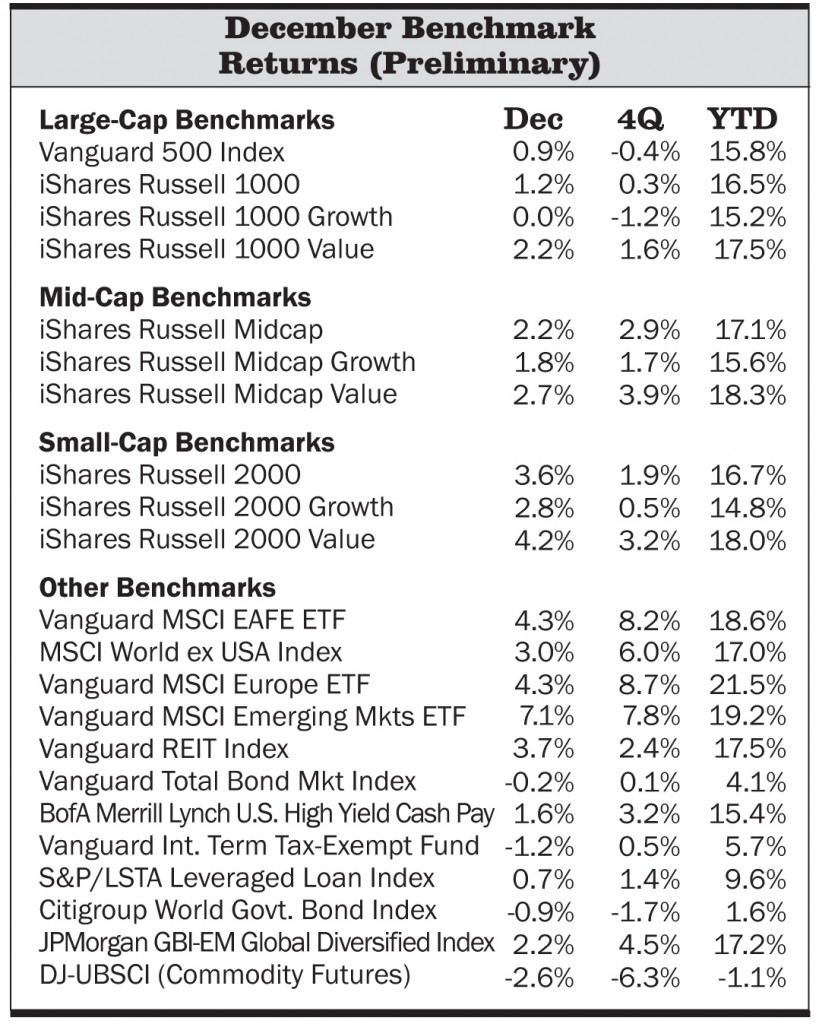

The bond side also saw riskier asset classes out-earning traditionally safer fixed-income market sectors for the year. Emerging-markets local-currency bonds notably gained 17%. Domestically, high-yield bonds and leveraged loans returned 15% and nearly 10%, respectfully, while investment-grade bonds returned 4%.

Can the markets continue to climb the proverbial wall of worry? Certainly the worries remain. The most immediate has to do with the spending side of the fiscal cliff. The cliff deal made permanent the Bush tax cuts for all but high-income taxpayers but it did not address spending. The threat of sequestration is still with us (these are the automatic across-the-board spending cuts), though delayed for two months. The timing now coincides with the need to extend the debt ceiling in March. So while the worst case of the cliff was avoided, the work is not nearly done. In the bigger picture, this immediate concern is a sideshow. In the following pages we discuss our current assessment of the investment environment including a detailed look at what could go right, and tie it all back to our portfolio positioning.